As a former CU CIO and parent of four, my goal was to get my kids learning about financial services through a hands on approach.

– Richard Logan / CEO Incent

About Us

The Future of Youth Banking

Incent Offers

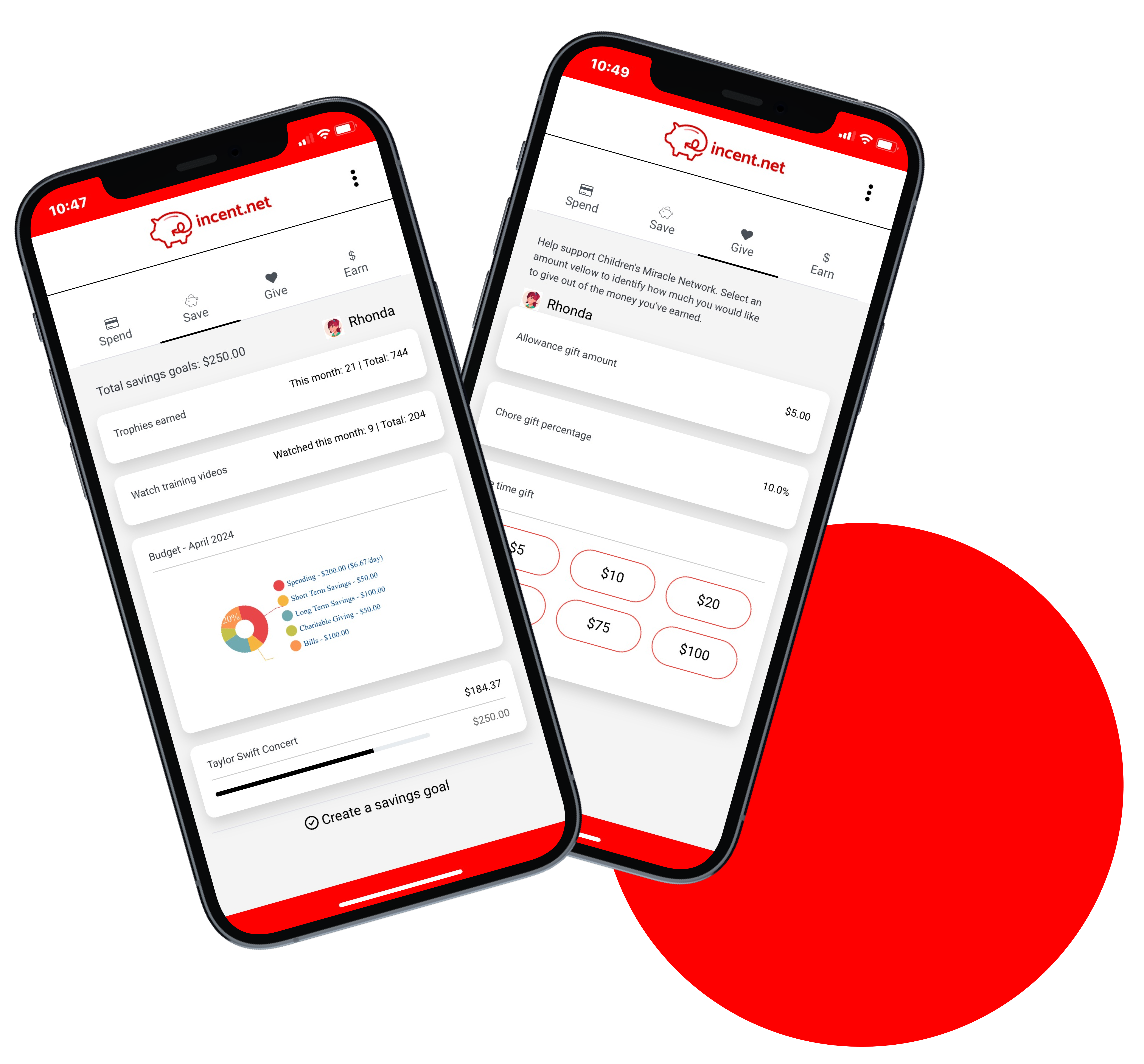

- Digital banking for kids and teens (Ages 0-24)

- White-labelled solution to keep deposits in-house

- Providing hands-on family financial education

- Seamlessly integrated into existing OLB

- Competitive way to earn deposits and grow accounts

Key Statistics

Below results are from surveyed credit union members

0%

of members/customers are with their financial institution for over a decade.

0%

of children chose not to bank at their parent’s credit union or bank.

0%

of members/customers recommended their financial institution to their adult children.

Feature Overview

Core Modules

Get Funds Moving

Youth Deposits

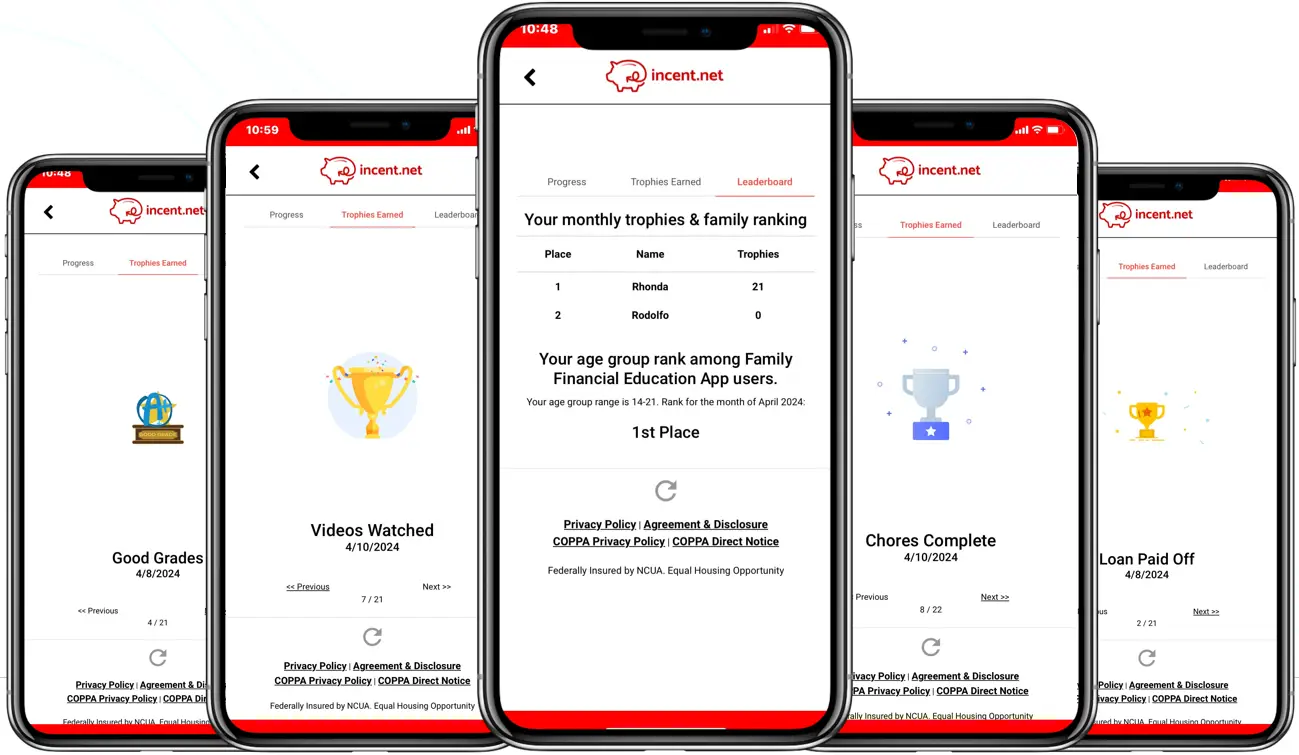

Gamification

Kids and Teens Earn Trophies For Making Sound Financial Decisions